- Home

- News & Features

- Press Releases

- FY2019

- Collaborating with credit union founded by Peruvians of Japanese descent to support small and medium-sized businesses in Peru -JICA’s first subordinated loan-

Press Releases

December 19, 2019

Collaborating with credit union founded by Peruvians of Japanese descent to support small and medium-sized businesses in Peru -JICA’s first subordinated loan-

at the signing ceremony in Lima

at the signing ceremony in Lima

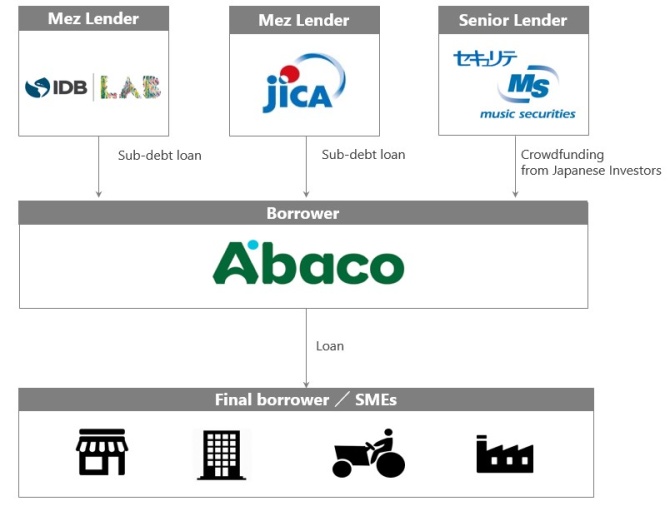

On Dec 18th, the Japan International Cooperation Agency (JICA) signed a contract with Cooperativa de Ahorro y Crédito ABACO (ABACO), a credit union founded by Peruvians of Japanese descent in Lima, Peru, to provide ABACO with up to US $10 million in subordinated loans. This project marks not only JICA’s first subordinated loan, but also its first private sector overseas investment financing project in Peru and its first co-financing with IDB Lab (*), the innovation laboratory of the Inter-American Development Bank (IDB).

ABACO was founded in 1981 by 32 friends (mostly descents of Japanese) based on Tanomoshi-ko, the concept of a traditional Japanese mutual aid (finance) association. Since its founding, the credit union has continually promoted mutual aid as a means of improving the welfare of and extending financial services to its members throughout Peru. During the 1980s, Peru underwent a time of terrorism, which caused many people to be distrustful of others. In that environment, the value of services of ABACO based on its philosophy of mutual aid was broadly recognized, and today the union has grown to include more than 25 thousand members of both Japanese and non-Japanese descent, making it one of the largest credit unions in Peru. Additionally, with IDB Lab support, ABACO has provided financing with small and medium-sized enterprises (SMEs) including agricultural businesses through financial intermediaries such as credit unions and microfinance institutions in rural areas where access to financial services is limited. ABACO also fulfills other important functions in Japanese Peruvian society, such as by serving as sponsor of local cultural exchange events between Japan and Peru called “Matsuri” (festivals) and by participating in the directorship of the Japan-Peru Chamber of Commerce.

In Peru, SMEs are the foundation of economy, accounting for 99.9% of all businesses and 82.4% of all employment. On the other hand, only about 6% of SMEs receive loans, and there is a U.S. $10.2 billion shortfall in the amount of financing available to SMEs, making promotion of SME access to financing an important issue to sustainable economic and social development. In recognition of this situation, the Peruvian government aims to raise the proportion of SMEs, which can receive loans up to 50% by 2021 in its inclusive national financial strategy.

Peru has about 100,000 residents of Japanese descents. Commemorating the 120th anniversary of the beginning of Japanese emigration to Peru, 2019 has been designated as "Japan-Peru Friendship Year" (Spanish: “Año de la Amistad Peruano Japonesa”), and relations between the two countries have been deepened through various events. This project supporting SMEs in Peru, by working together with ABACO, which has sustained “Nikkei” community through its financial support, demonstrates a new relationship between Japan and the Nikkei Community.

Furthermore, through micro-investment crowdfunding (**) platform called "Securite" operated by Music Securities Inc. (MS), ABACO raises money from individual investors in Japan for the purpose of financing agricultural businesses. JICA concluded a business alliance memorandum with MS in 2017, and it is exploring courses of future collaboration.

Through such arrangements, JICA continually strives to leverage private sector power in Peru and other countries of Latin America on behalf of regional development.

(*) IDB Lab is the innovation laboratory of the IDB Group, the leading source of development finance and know-how for improving lives in Latin America and the Caribbean (LAC). The purpose of IDB Lab is to drive innovation for inclusion in the region, by mobilizing financing, knowledge, and connections to co-create solutions capable of transforming the lives of vulnerable populations affected by economic, social or environmental factors. Since 1993 IDB Lab has approved more than US$2 billion in projects deployed across 26 LAC countries. As of October 29, 2018, IDB Lab is the new identity of the Multilateral Investment Fund (MIF).

(**) Micro-investment crowdfunding: In Japan, crowdfunding is generally categorized as purchase-type crowdfunding, donation-type crowdfunding, or finance-type crowdfunding. Of these, the features of finance-type crowdfunding using an anonymous partnership agreement are that (1) it is conducted through a platform by a broker that is registered as a financial instrument business (a type 2 financial instruments business operator), (2) funds provided through anonymous partnership agreements have the nature of equity, and (3) loans are made up of small amounts collected through the internet from an unspecified number of individuals.

(Source: Kyōkan-sei ni sasaerareta aratana kin'yū shuhō: Chūshō reisai kigyō-muke kin'yū shien no aratana chihei [New empathy-supported financing method: New horizons for financial support to SMEs] JICA / IDB Lab, 2017)

Reference: Scheme diagram

- About JICA

- News & Features

- Countries & Regions

- Our Work

- Thematic Issues

- Types of Assistance

- Partnerships with Other Development Partners

- Climate Change / Environmental and Social Considerations

- Evaluations

- Compliance and Anti-corruption

- Science and Technology Cooperation on Global Issues

- Research

- JICA Development Studies Program / JICA Chair

- Support for the Acceptance of Foreign HRs / Multicultural and Inclusive Community

- Publications

- Investor Relations