JICA: Credit risk database project with BSP offers bright spot for SME financing amid COVID-19

2021.01.06

As lack of finance access continues to challenge Philippine small and medium enterprises (SMEs), an ongoing Technical Cooperation Projects for the Establishment of Credit Risk Database (CRD) of the Japan International Cooperation Agency (JICA) and the Bangko Sentral ng Pilipinas (BSP) offers new prospects.

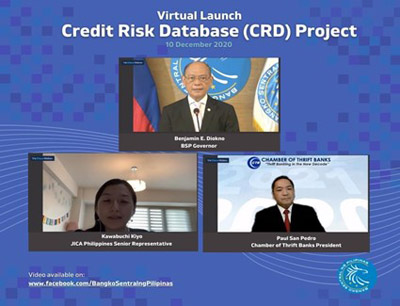

Governor Benjamin Diokno of BSP, President Cecilio San Pedro of the Chamber of Thrift Banks, and officials from JICA, led the recently held virtual launch of the project.

"We've finished the feasibility study for the project that helped pave the way for a technical cooperation between JICA and BSP on formally establishing a credit risk database of local enterprises," JICA Senior Representative KAWABUCHI Kiyo said. "The pandemic brought about disruptions and difficulties which spared no one, including SMEs. Through this project, we look forward to working with more financial institutions and banks so we can mainstream CRD and support economic recovery of SMEs."

BSP Governor Diokno shared that "Prior to the onset of COVID-19, MSME loans from Philippine banks were only at 8.8% of total business loans and 6.1% of total loans. The two factors according to him are the reluctance of MSMEs to approach banks due to lack of credit history and acceptable collateral and perception on MSMEs as high-risk.

Governor Diokno also highlighted that "The project is a tangible step in building a sustainable financing ecosystem for SMEs. Banks, on the other hand, will benefit from the robust credit scoring models built on the database to supplement or to validate their internal scoring models. This will particularly be useful to those without a credit scoring model. The CRD will enhance the credit risk management system of banks."

An expert team from CRD Association and CRD Business Support Limited of Japan which currently operate and maintain the CRD in Japan will also collaborate with BSP in this project.

Already, many banks have conveyed participation in the project that will be implemented for three years. The initiative includes creating a scoring model based on a database built from information gathered from banks.

In Japan, such CRD system helped improve credit access of SMEs using a tool that analyzes credit risk information.

In the Philippines, the Philippine Magna Carta for Small Enterprises has consolidated all programs for MSME development in the Philippines. The project in a way will also help improve risk perception on small businesses and improve their access to finance.

© Bangko Sentral ng Pilipinas

scroll