Sector Overview

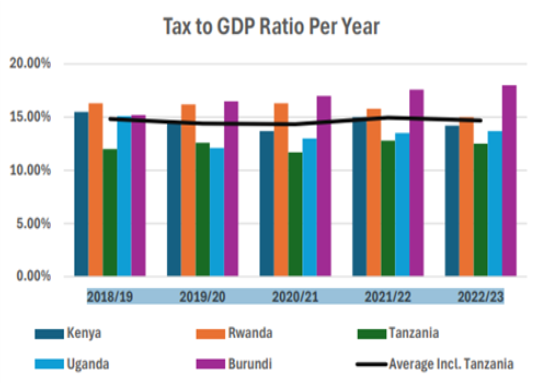

The low ratio of tax revenue to GDP is an issue to be addressed. In addition, it is necessary to improve budget planning capabilities and the budget execution rate in public spending.

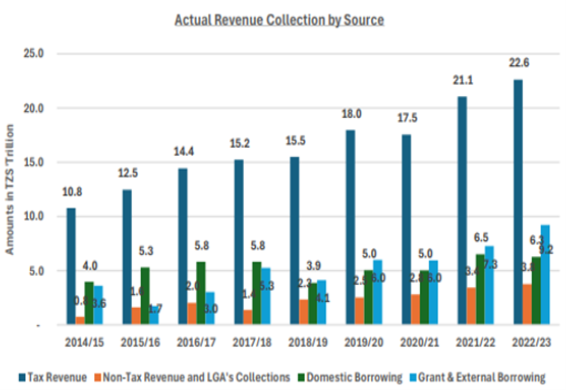

The fiscal deficit hovers around 3% of GDP, of which about 2/3 is covered by external borrowing (half of which is concessional). Public debt is about 40% of GDP, and although the IMF's Debt Sustainability Assessment (DSA) was raised to Moderate in 2021, the status is said to be manageable. Revenues have been increasing year by year, and although tax revenues account for about 80% of them, the ratio of tax revenues to GDP is about 13%, far below the SSA average of about 16%.

Tax Revenue as a Percentage of GDP

(Source: Ripoti za CAG| National Audit office of Tanzania (NAOT))

The budget execution rate is low, and the improvement of financial management capabilities such as planning, and execution is an issue to be addressed. Comprehensive fiscal reforms are needed for sustainable economic growth and improved public services.

Budget Execution Rate of Current Expenditure

(Source: Tanzania Economic Update -The Efficiency and Effectiveness of Fiscal Policy in Tanzania)

scroll