HAKKI AFRICA is a microfinance company that uses a unique credit scoring system to support impoverished African people who have no credit history and are unable to get loans. The pilot project was conducted through the JICA's Africa Open Innovation Challenge (AOIC). Mr. Takeuchi Tomonari of Deloitte Tohmatsu, also co-founder of ICT for Development Japan (ICT4D) , was involved in the program's launch, operation, and support of participating startups.

Summary

Project

Africa Open Innovation Challenge (AOIC) *

Company

HAKKI AFRICA INC

Profile

HAKKI AFRICA is a startup that primarily provides microfinance, using cars as collateral in Kenya. The company developed a unique credit scoring system that can help in providing finance to those with an insufficient credit history, enhancing their economic independence and maximizing opportunity. In 2021, HAKKI AFRICA worked through AOIC to conduct a microfinance pilot project for Tanzanian farmworkers in order to stimulate the market.

* AOIC is a program that invites private companies and academic research institutes to employ digital technologies to solve issues in such fields as education and agriculture in Africa. The program is part of two projects: “Survey on open innovation through utilizing disruptive digital technologies in Africa,” and “Survey and research to promote the utilization of science, technology and innovation for solving social development issues in the Africa and Sub-Saharan Africa regions.”

Index

Is it possible - small loans to make trust on individuals?

CHAPTER1 The Issue

Financial systems in Africa are not similar to Japan. Many businesses have no access to finance due to a lack of access to credit. HAKKI AFRICA has developed an innovative credit scoring system that can help in providing small loans to people who have difficulty proving their credit rating, such as those without an address or social security.

HAKKI AFRICA first attempted to provide small loans to retailers in Nairobi, the capital of Kenya. Nairobi is saturated with financers, however, and there were many cases where the loans were used to repay prior debts, rather than used for business development. Some borrowers, in fact, had already incurred multiple debts.

Mr. Kobayashi Reiji, HAKKI AFRICA CEO

Mr. Kobayashi Reiji, the CEO of HAKKI AFRICA, said that his startup’s original aim was for the loaned funds to be used to add value to the borrower’s business. However, in reality, many retailers used the loans for purchases. Mr. Kobayashi then decided to work with JICA's Africa Open Innovation Challenge (AOIC) to conduct a pilot project providing unsecured, small loans to farmers in Tanzania. Through this, he acquired practical knowledge about agricultural finance operations in Africa.

“I saw potential in agricultural finance because it was an area that had already been proven in Southeast Asia,” said Mr. Kobayashi. “If successful in Tanzania, the program could easily be expanded to Kenya, where there are many farmers. Unlike with retail finance, I thought I could more easily encourage farmers to work on value-added activities—such as using the loan to increase the amount of their farmland.”

Mr. Takeuchi Tomonari, Senior Manager of Deloitte Tohmatsu LLC

Mr. Takeuchi of Deloitte Tohmatsu, which supports implementing AOIC, believes in the significance of co-creation by startups and JICA in emerging countries. “These countries have many issues that cannot be understood until one actually lives there,” he said. “Startups that are not familiar with local business have a hard time identifying issues at first. We at AOIC can accompany startups from the start, and identify issues using the technical cooperation of a team of Japanese experts and local partners. JICA's name can also be of great help in building a local business network.”

Identifying issues from a local perspective leads to new business

CHAPTER2 Collaboration with JICA

While running the pilot project in Tanzania, Mr. Kobayashi and his colleagues were encouraged by advice from JICA Representatives. “The only thing large companies have to do is test whether their existing products fit the market,” he said. “But startups like ourselves need to create products that meet the needs of the country or the region. JICA's Japanese Experts, Extension Staff of SHEP

[Smallholder Horticulture Empowerment & Promotion], and other local partners, had been working in the area for years. They helped us not only to identify issues in terms of funds and resources, but also to keep our motivations in unfamiliar environment.”

Plus, partnering with JICA proved to be an advantage in networking. “Initially, we planned to provide microfinance services in Tanzania on our own,” Mr. Kobayashi said. “But obtaining a financial license in Tanzania was uneasy.” He decided to partner with a licensed microfinance company as a service provider to financial institutions. “Local government officials in Tanzania and JICA local partners helped us find a local finance partner,” he said. “Thanks to all their work, we were able to achieve this so quickly.”

JICA’s expertise and network helped HAKKI AFRICA through the pilot program, though the project did face difficulties. It is said that in Southeast Asia, group lending with five people could prevent bad debts through joint liability. Said Mr. Kobayashi, “This did not apply to the Tanzania project. Because of the nature of agriculture, there were many cases where farmers were unable to repay their loans due to delayed harvests.”

He believes that one major lesson learned from the project was that even group lending can’t prevent bad debts if the loans are not used to improve the future of the business. “For example,” Mr. Kobayashi said, “It is important to provide loans for concrete business development, such as irrigation equipment to increase productivity. JICA gave us the opportunity, through the support of its expertise and network, to learn this at the pilot stage. Insights from the pilot were essential to our current business operations.”

Projects in emerging countries tend to focus on the financial success of the project. But Mr. Takeuchi believes that JICA’s value is that its projects primarily focus on solving local social issues. “JICA is focusing not on short-term profits but on development,” he said. “This can lead to the discovery of local realities and real needs, in some cases. Through this pilot, HAKKI AFRICA gained new insights from a local perspective then I would say the collaboration with JICA was a success.”

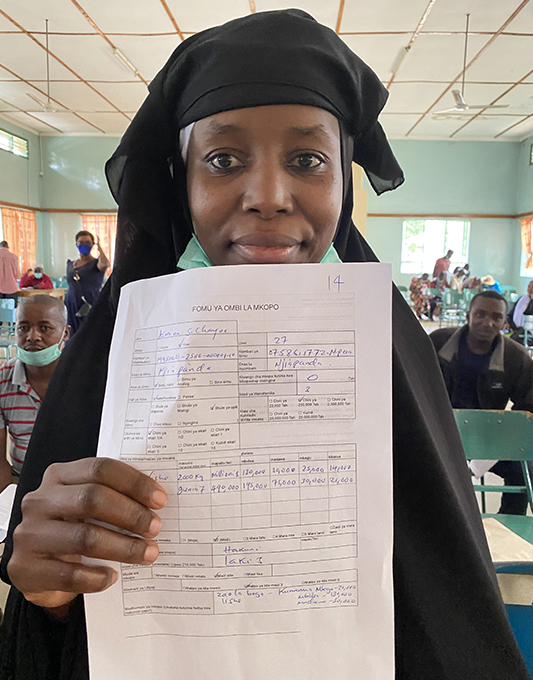

Briefing session on loans for farmworkers

Empowering people changes lives. System building is nation building.

CHAPTER3 Achievements

HAKKI AFRICA started in Kenya, where it developed a financial service for taxi drivers. A credit scoring system allowed drivers to use their cars as collateral when applying for loans.

Prior to running the pilot project in Tanzania, bad debts exceeded several dozen percent on mostly unsecured loans. Utilizing the lessons learned from the pilot, Mr. Kobayashi decided to use movable collateral, which has a lower default rate. Today, the company has about 690 current borrowers, with a favorable loan loss rate of only 0.09 percent. “We understood that providing specific business items reduces unnecessary screenings,” he said. “Financiers can reduce bad debts by actually consulting on the borrower’s business.”

Farmworker with loan application form

There are about 200,000 taxi operators in Kenya. Since Uber entered the market in 2016, the number of online service drivers has also increased. Mr. Kobayashi said that 70 percent of the drivers cannot afford a car due to lack of access to finance, and rent cars instead. “Even if they could borrow money, unsecured loans have high interest rates that they would never be able to pay back,” he said. “I want to build a financing system with lower rates so that sincere, hardworking people can take on more challenges and increase their wealth.”

Mr. Kobayashi believes that the lack of such systems in emerging economies robs people of hope; they believe that no matter how hard they try, they will never escape from poverty. Credit scoring can help lenders visualize an individual’s credibility beyond finance, and give people a chance to change their lives. “If more people seize the opportunity and become happy using our business, it could change the country,” he said. “People often ask me, ‘What motivate you to come Africa?’ But I originally didn't have any special agenda or formative experience. I just want to simply take part in establishing new systems in this frontier. Ultimately, I believe that building a system is building a nation."

Mr. Kobayashi is attracted by the process of creating new possibilities for the future. “Doing business in emerging countries is not easy,” he said. “I tell companies not to enter if they feel hesitant. But if a company is passionate about finding solutions to big issues, partnering with JICA will generate good synergies. JICA is in other words platformer and catalyst. They are professionals who understand local issues and the language of startups and connect both sides. No other organization assigns as many personnel to sites in emerging countries as JICA."

Tanzanian farmers applying for a loan at a briefing session

Comments from project member

Then JICA Africa Department Motoharu Wakabayashi

In order to solve complex social issues in Africa, it is important to utilize wisdom, technology, and wide networks to explore solutions. AOIC calls for open innovative solutions to JICA projects and social issues in African countries, and works with select companies as well as academic and research institutions to find sustainable solutions. We have many open innovation events, but only a few cases are able to take the next step. This HAKKI AFRICA case is a rare example where Deloitte Tohmatsu's careful follow-up, JICA's local awareness and network, and HAKKI's technology ultimately led to commercial success. We set high expectations as a catalyst and platformer for future international cooperation.

JICA DXLab projects

- CASE STUDIES 5 Satellite Data Used to Predict the Future of the Earth's Environment

- CASE STUDIES 3 An Innovative Solution to the Global Water Crisis

- CASE STUDIES 2 From Kagawa, Saving Mothers and Children in Asia

- CASE STUDIES 1 A Revolution for a Billion People - Agri-tech Challenges in India

- DX Lab 1 Using AI to Detect Elephants Early and Promote Coexistence with Humans

- INTERVIEWS 3 Supporting Startups Aiming for Social Innovation in Developing Countries through Google's Accelerator Program

- INTERVIEWS 2 Challenge in Bhutan! Using Health Data to Promote People’s Health and Wellbeing

- INTERVIEWS 1 Roundtable: Telemedicine Startup × VC × JICA

scroll