Summary

Details of Implementation

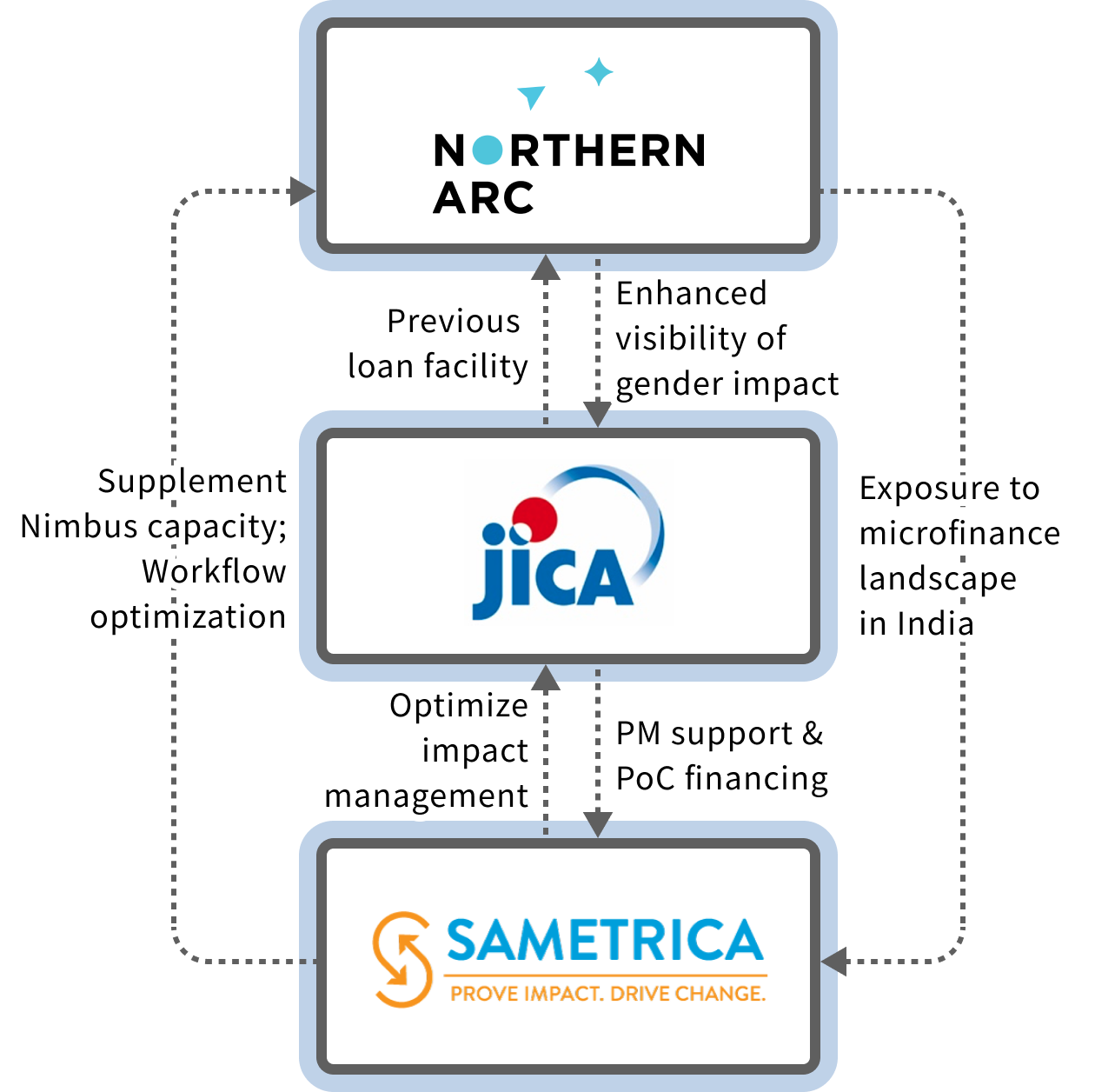

Following the $50 million loan agreement in 2021 with Northern Arc to improve women’s financial access through microfinance in India, JICA saw an opportunity to enhance data management practices and capture a wider range of detailed data by leveraging the expertise of technology players. This pilot initiativeselected a technology player in this area, to optimize reporting workflow, streamline data management, and allow detailed impact measurement with an ultimate goal to drive greater gender impact.

Digital Partner

Timeline

Approximately four months between Mid-June and Mid-October

Status

Index

Project Context

In the Gender Gap Index, which measures gender inequalities, India is ranked 112th out of 153 countries (Global Gender Gap Report 2020), representing a country with a huge gender imbalance. In particular, opportunities for women to participate in economic activities are limited. It is estimated that over 40% of the country's female population, or about 280 million women, have no access to financial services. In response to these circumstances, the Government of India has identified the improvement of women's access to finance as one of its priority issues.

Non-Banking Financial Companies (NBFCs), which have branches in provincial areas and extensively provide loans to individuals, play an important role in this regard. On August 25th, 2021, JICA signed a $50 million loan agreement with India-based Northern Arc Capital (Northern Arc) to improve women’s financial access through microfinance. In measuring and monitoring gender impacts, Northern Arc employs their in-house system called Nimbus to facilitate data management, tracking of proceeds, and streamlining their scoring. JICA saw an opportunity to enhance its data management practices and capture a wider range of detailed data by leveraging the expertise of technology players in this area, as it also seeks a mechanism and methodology for efficient and more detailed impact measurement to manage its growing global impact investing portfolio.

We recruited solutions publicly and reached out to technology companies to join competitive bidding. After careful consideration, SAMETRICA has been selected as a Digital Partner for this PoC to validate methodologies for detailed impact measurement and integration of impact-related data for better management.

PoC Implementation Requirements

Details of Implementation

Impacts will be assessed based on both quantitative and qualitative indicators that have been aligned with various ESG and impact standards with a particular focus on gender.

Qualitative data collection will include in-person interviews and surveys with female end-borrowers across India.

Timeline

Approximately four months between Mid-June and Mid-October

Participating NBFCs

- Arohan Financial Services Limited (Kolkata)

- Dvara KGFS (Chennai)

- Satya Microcapital Limited (New Delhi)

Required Technologies

- Data IntegrationTo bring a unified view of data from different systems and identify impact and ESG performance

- Reporting AutomationTo produce real-time custom and standard reports

- De-identificationTo comply with privacy and data regulation while completing cohort analysis without housing any personally identifiable information

RESULT

Outline of Implementation

Three Non-Banking Financial Companies (NBFCs) and over 2,800 borrowers participated in this PoC to collect quantitative and qualitative data on the impact of loans to improve financial access for women by Northern Arc.

To collect qualitative data, we interviewed borrowers about the impact of the loans on their lives through telephone, in-person, and social networking services. The survey was conducted in four languages (Hindi, Tamil, Bengali, and English), taking into account literacy rates and cultural norms. For quantitative data, Northern Arc's data management system, NIMBUS, was connected to SAMETRICA's platform via an API, and data such as loan amounts held by Northern Arc were aggregated on SAMETRICA's platform. In addition to this, public data (wage data, employment rates, health status, etc.), SAMETRICA's own data sets and algorithms were combined to analyze impact and visualize the results on a dashboard.

As a result, a detailed impact evaluation based on more diverse quantitative and qualitative data was possible. For example, in the area of education, we found that "more than 155 students were able to attend school thanks to the loan" and "a loan of Rs. 1 created an impact equivalent to Rs. 20.30 on average," which gave us an idea of the extent to which the loan improved the lives of women. The analysis process also validated an optimized data collection, management, and integration approach, and the implications were summarized in a report.

Results Report

Please see the results report below.

Project members

Digital Partner

- Finalize impact reporting requirements

- Develop API to connect data platforms

- Configure data collector, logic model builder and dashboards

- Recruit/train surveyors and perform data collection

- Operate and maintain the data platform for continuous data monitoring

- Collate, analyze, and discuss learnings

SAMETRICA is a software-as-a-service company that enables asset managers to demonstrate their social, economic, environmental, and governance progress and impact. SAMETRICA's platform integrates data collection, impact framework and business intelligence reporting to create an automated, easy-to-use system that can scale for all sizes and complexities of impact investing activities, allowing clients to create aggregated reporting across multiple portfolio companies.

SAMETRICA Official website

Anshula Chowdhury

CEO & Founder of SAMETRICA

SAMETRICA is pleased to partner with JICA and Northern Arc on this exciting project. Using SAMETRICA's ESG and impact reporting platform, proprietary datasets, and expertise will enable the demonstration of real time impacts across JICA and Northern Arc's operations. The focus on gender-based impacts, alignment with various global ESG and impact frameworks, and ability to gather data directly from beneficiaries will represent a significant step forward in realizing the potential for ESG and impact reporting capabilities.

Comments after project implementation

Anshula Chowdhury

SAMETRICA is proud to have played a pivotal role in the successful completion of the Proof of Concept (PoC) project with JICA, where our platform was instrumental in managing data collection across diverse environments in India. By leveraging our proprietary technology, we delivered real-time, actionable impact assessments through comprehensive dashboards that directly supported decision-making for asset managers. Dashboards were provided in our platform, and also delivered via API to the Nimbus system.

Our ground teams seamlessly adapted to evolving requirements and complex data environments, ensuring data integrity and relevance while maintaining the high standards essential for such transformative projects.

The success of this PoC has affirmed the scalability of our approach to granular, beneficiary-level data collection and provided valuable insights. We are excited to continue our partnership with JICA, harnessing our enhanced capabilities to empower global partners with cutting-edge solutions for meaningful and measurable impact. The outcomes and experiences from this collaboration will further refine SAMETRICA's impact measurement capabilities, align us with globally recognized frameworks, and set new benchmarks in scalable impact reporting.

Project Owner

Ashish Mehrotra

Northern Arc Capital Limited

Northern Arc Capital Limited is a diversified financial services platform, established with the paramount objective of addressing the multifarious credit requirements of the underserved population. Our aim is to deliver efficient and dependable access to finance within our core sectors. We accomplish this through a comprehensive and multifaceted approach, leveraging not only our extensive network but also that of our esteemed financial institution partners, thereby ensuring a broader reach to customers across the vast expanse of India.

To realize this ambitious vision, we harness the power of our profound data insights spanning six sectors, underpinned by an impressive repository of over 66 million loan records. Our unwavering commitment to cutting-edge technology empowers us to offer a seamless credit flow experience to our end customers. At the forefront of this journey lies Nimbus, our proprietary debt platform, which plays a pivotal role in fostering the growth of credit within the Indian ecosystem. It facilitates end-to-end transactions and provides profound data analytics, elevating the efficiency and efficacy of our operations.

Comments after project implementation

Ashish Mehrotra

Northern Arc Capital Limited partnering with JICA DXLab for the Proof of Concept (PoC) for “Validation of Data Platform and Impact Measurement Methodology to Increase Women’s Financial Access in India” was a great learning experience for Northern Arc. The project design, structuring of the survey based on international frameworks, and the timely coordination by JICA’s DXLab, and their Office of Gender Equality and Poverty Reduction created an opportunity to develop methodologies and understand the defining factors governing impact measurement and reporting. The multi-faceted approach of this PoC for capturing impact data along with enabling NIMBUS (Northern Arc’s proprietary debt platform) to manifest impact created through our lending has validated NIMBUS’ capability capture data for impact reporting to our stakeholders. This PoC has empowered Northern Arc to explore and track impact related data from our intermediate retail lending partners and our direct retail lending business for meaningful impact disclosure across each line of our business. The approach and the outcomes of this PoC will aid Northern Arc Capital Limited enhance its impact measurement capabilities in accordance with globally recognized frameworks.

Sponsor

Reiko Wakatsuki

Officer, Office for Gender Equality and Poverty Reduction, Governance and Peacebuilding Department, JICA

JICA has set forth its Global Agenda for Gender Equality and Women's Empowerment, a business strategy to address issues in developing countries, and the Office for Gender Equality and Poverty Reduction is working to promote the economic empowerment of women in various ways toward a society in which everyone can fulfill their potential regardless of their gender. It has been seeking to visualize whether such efforts are truly contributing to the empowerment of individual women, and we are given the opportunity to participate in this PoC to visualize the impact of women's financial inclusion projects through NAC, one of the Private Sector Investment Finance (PSIF) Program. By collaborating with the Overseas Investment and Loan Division, NAC, and various people involved in this PoC, we aim to measure and visualize the impact of women's access to finance, income, and agency. We hope to apply this experience to future women's empowerment projects.

Yosuke Sato

Senior Deputy Director, Private Sector Investment Finance Division, JICA

This PoC is an effort to visualize the development impact of JICA's Private Sector Investment Finance (PSIF) Program. JICA's PSIF, in collaboration with the Office for Gender Equality and Poverty Reduction, is focusing on efforts to promote financial inclusion of vulnerable groups, including female, in developing countries. We feel it is important to learn more deeply (preferably in real time) about the actual impact of such projects to see if they are making a positive difference in the lives of individuals. Northern Arc Capital Limited is a digitally oriented financial institution that plans to further promote impact investment and we believe that they are the best partner for this PoC. We are pleased to be able to take the first step in this steady but potentially significant initiative together with the parties involved.

Comments after project implementation

TAKUMI KUNITAKE

Director, Office for Gender Equality and Poverty Reduction, Governance and Peace Building Department

Through the POC, it was confirmed that loans from JICA’s private finance to Northern Arc have brought to the women customers the positive changes including improvement of quality of life, increase of education spending and better quality of meals. Joint project with Northern Arc and Sametrica provided JICA with an opportunity to learn methodologies of measurement and visualization of project’s impacts. JICA will utilize the learnings from the POC for impact measurement in the future.

Partner Relationship

For those interested in co-creation with JICA DX

Other projects from JICA DXLab

- PROJECT 19 PoC for National Bank of Cambodia AI-based Liquidity Forecasting Solution

- PROJECT 18 AI-driven geospatial analytics for cost effective crop cutting experiment in Ethiopian Insurance

- PROJECT 17 Green/Carbon Credit Registration, and Wildlife Habitat Monitoring in Rajasthan

- PROJECT 16 Development the Forest Stack Data Exchange Platform in Rajasthan

- PROJECT 15 Bengaluru Transport Stack - DPI to revolutionize mobility experience and foster innovation ecosystem in Bengaluru

- PROJECT 14 Mumbai Transport Stack –DPI to revolutionize mobility experience and foster innovation ecosystem in Mumbai

- PROJECT 13 PoC for Cambodia Last Mile Delivery Solution

- PROJECT 12 AI Startup Accelerator Program in Vietnam

- PROJECT 11 PoC for Dhaka Metro Mobility Application

- PROJECT 10 PoC for Non-Revenue Water reduction and E2E utility management with ZAWA

- PROJECT 9 Forest Stack PoC for Digital Forest Health Monitoring System in Rajasthan

- PROJECT 8 Forest Stack PoC for Carbon Credit Project Registration in Odisha

- PROJECT 7 Development and implementation of Meter Reading App, Management Dashboard & NRW Monitoring Tool at CWASA

- PROJECT 6 Exploring Innovative Digital Pathways for Horticulture Market Linkage in Himachal Pradesh and Uttarakhand

- PROJECT 5 Unlocking Digital Agri-advisory Solutions to Boost Productivity for Uttarakhand Horticulture Farmers

- PROJECT 4 PoC for Big Data Analysis on Customer Profiling and People Movement in Blok M TOD Area with MRT Jakarta

- PROJECT 2 Technology Testing to Mitigate Human-Elephant Conflict and Promote Coexistence in West Bengal

- PROJECT 1 Digital Talent Development in Ethiopia to Foster Innovation and Address Youth Unemployment

scroll