Bringing Peace and Stability to the World through Finance. The Story Behind the Peacebuilding Bond

2022.10.18

Social Bonds have recently been attracting global and domestic investors. These bonds are issued to raise funds for projects that address social issues; and has a mechanism that allows private funds to play a role in contributing to the achievement of the SDGs—the United Nation’s Sustainable Development Goals. In July, JICA issued a new Social Bond called the Peacebuilding Bond, which is designed to strengthen efforts toward a peaceful society and aims to achieve Goal 16 of the SDGs.

Ms. HIRATA Momo from JICA’s Treasury, Finance and Accounting Department.

There were 56 ongoing armed conflicts in the world as of 2020, and the number of refugees and displaced persons has exceeded 100 million this year. Both of these figures are the worst on record and are still on the rise. The violent conflicts in Syria, Afghanistan, and Ethiopia, not to mention Military invasion of Ukraine, has threatened people’s lives and greatly hindered sustainable development.

JICA is supporting the difficult task of building resilient countries and societies in Asia, Africa, the Middle East, and Europe in order to prevent conflicts. The Peacebuilding Bond was issued as part of our efforts to further the development of global peace and stability. We hope it will also raise awareness about the current state of conflicts in the world and our peacebuilding efforts.

Ms. HIRATA Momo of JICA’s Finance and Accounting Department leads the issuance of Peacebuilding Bonds. “This bond is the first of its kind in Japan that the proceeds will be earmarked exclusively for projects aimed at building peace,” she says. “Conflicts around the world are on the rise and the challenges to be solved are increasing. So, we thought this was the right theme at a time when there is growing interest in peacebuilding, both domestically and internationally.”

Since fiscal year 2008, JICA has raised a portion of the funds by issuing JICA Bonds (Japan International Cooperation Agency Bonds) in the capital market. In fiscal year 2016, JICA became the Japan’s first issuer of Social Bonds whose exclusive purpose is to finance social projects addressing social issues in accordance with the Social Bonds Principle of the International Capital Market Association *1. Since then, all bonds issued in Japan by JICA have been issued as Social Bonds.

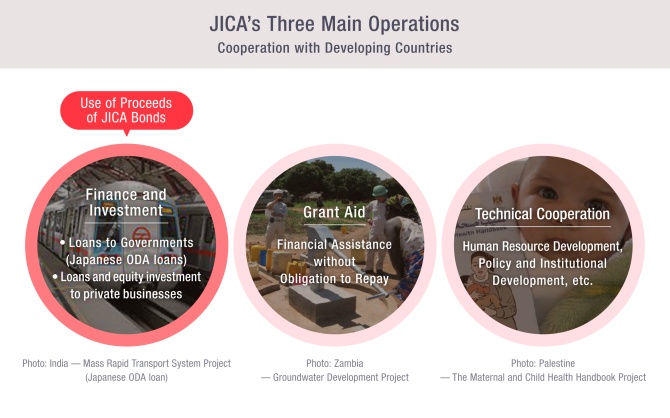

JICA is implementing agency of Japanese Official Development Assistance (ODA), carrying out projects for the socio-economic development of developing regions. Its three main operations are finance and investment, grant aid, and technical cooperation. The funds raised by JICA bonds will be used for the Finance and Investment projects (i.e., “ODA loans,” which are loans to governments of developing countries, and “Private Sector Investment Finance,” which are lending or equity investment to private-sector entities).

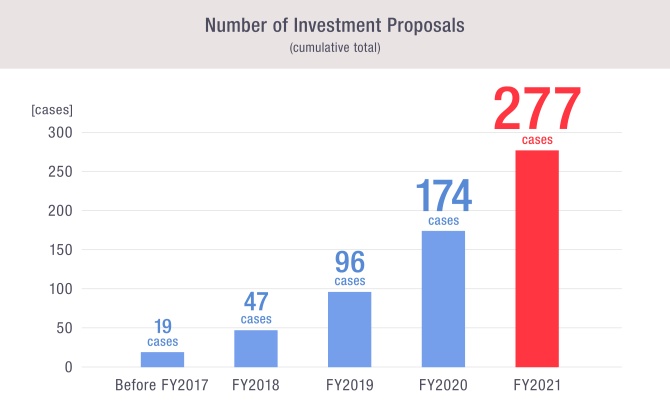

The number of investment announcements *2 for JICA Bonds has been increasing, notably since fiscal year 2017, reaching a cumulative total of 277 by fiscal year 2021. “The reason behind this increase is an awareness of JICA Bonds, as well as the fact that investors—including corporations and local governments—and the general public are becoming more interested in the SDGs,” says Ms. Hirata.

JICA Bonds are also positioned in the Japanese government’s policies as a tool for mobilizing funds to achieve the SDGs.

As JICA contributes to all 17 SDG goals, some investors voiced their preference for the use of bond proceeds to be narrowed to better understand their impact. To address this, JICA began issuing Theme Bonds targeted at specific themes or regions, beginning in fiscal year 2019. We started with the TICAD Bonds issued in the wake of the Tokyo International Conference on African Development (TICAD) that was held in Yokohama, Japan. That was followed by the issuance of the COVID-19 Response Social Bonds in fiscal year 2020, and Gender Bonds in fiscal year 2021.

“We received a lot of positive feedback on how easy it was to understand the themes,” says Ms. Hirata. “We received a particularly favorable response to the Gender Bonds, which allocate the use of proceeds to projects promoting gender equality and women’s empowerment. We sensed a high level of interest in gender issues.”

*2: An investment statement is a public announcement of an investment made at the investor’s initiative.

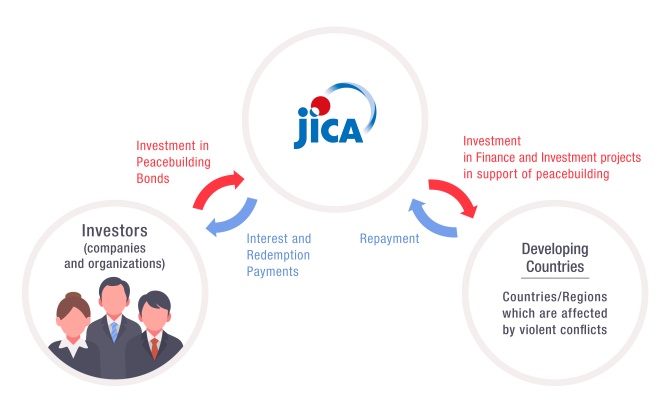

The Peacebuilding Bond is the fourth in the series of bond themes. The proceeds from the bonds will be allocated to ongoing or new projects in countries or regions which are affected by violent conflicts.. The projects will assist the targeted countries to build resilient states and societies, and contribute to realizing a peaceful and just society.

How Peacebuilding Bonds Work

The proceeds from the bonds will be allocated to social infrastructure projects in Turkey, which has been hosting many Syrian refugees since breaking out of the Syrian Civil War in 2011. The projects support building a peaceful and livable society for both refugees and host communities. The proceeds will also be used to support the recovery and expansion of the road network in Mindanao Island, the Philippines. The island has been the scene of armed conflict since the 1970s.

The proceeds from the bonds will also go to post-war reconstruction assistance for Iraq.

Ms. Hirata feels that the Peacebuilding Bond is contributing to raising awareness about the current state of the world. She says that many investors in the Peacebuilding Bonds, including financial institutions, local governments, and corporations have announced their investment. A number of reasons for the investment were cited by the investors, such as:

“Coming from a country that has experienced wars, we want to contribute to world peace.”

“We want to invest in an effort that only a Japanese organization can lead, based on its experience in its own postwar recovery and reconstruction.”

“We want to entrust our investment to JICA, which has a proven track record in peacebuilding assistance.”

“This is the first time we have learned of the many conflicts going on in various parts of the world.”

JICA does not issue Peacebuilding Bonds for individual investors. It did, however, issue social bonds for individuals for the first time in seven years in February 2022. The retail bonds—called JICA SDGs Bonds—targeted individuals who can invest a minimum of ¥10,000(equivalent to USD70),and is scheduled to be issued again in this fiscal year around January to March 2023. The bond has been well received by young people in their teens and twenties as a simple way to contribute to international cooperation. A report by the Japan Securities Dealers Association states that, among all age groups, those in their 20s and 30s have the highest awareness and already holding bonds that contribute to the SDGs, such as JICA’s Social Bonds.

A promotional image of the JICA SDGs Bond, social bonds for individual investors. It says "Look for an easy start for international cooperation."

The governmental curriculum guideline for high schools was revised this school year. For the first time, financial education, including how to manage and invest savings, has become compulsory. Courses to enhance financial literacy have been included in the junior high school curriculums since the last school year. We can expect to see financial awareness among young people that will continue to rise in the future.

“As society becomes more aware of the SDGs including peacebuilding, I believe there will be more and more opportunities for people to choose investments as a tool for international cooperation and social contribution,” says Ms. Hirata. “Through the issuance of this Peacebuilding Bond, we aim to promote peace and stability in the world. At the same time, we would like for people to be more aware of conflicts and poverty—and to see global issues as a personal matter.”

JICA is also a regular US dollar bonds issuer.

scroll