Outline of Japanese ODA Loan with Currency Conversion Option

What is Japanese ODA Loan with Currency Conversion Option?

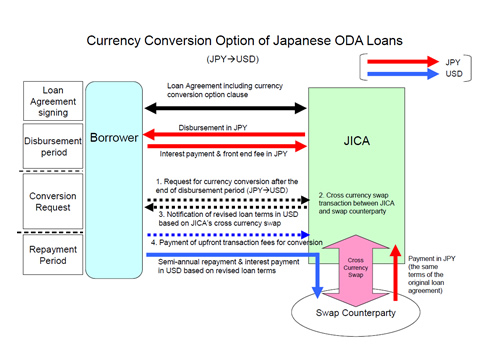

Japanese ODA Loan with Currency Conversion Option is a product that offers the borrower an option to convert the currency denomination of the loan from Japanese Yen(JPY) to United States Dollar (USD) after the completion of disbursement.

It helps the borrower reduce the foreign exchange risk associated with Yen-denominated Japanese ODA loans by fixing the repayment cash flow in USD terms, if the repayment is usually made out of the USD assets owned by the Borrower

Please see Summary of the Product and Guidelines for Currency Conversion of Japanese ODA Loans for the contents and procedures of the Product.

Eligibility and Major Conditions for Currency Conversion

| (At the time of the signing of L/A) | ||

|---|---|---|

| 1 | Country | All Countries eligible for Japanese ODA Loan. |

| 2 | Repayment Period | Either 15 years or 20 years. |

| (At the time of request for currency conversion) | ||

| 3 | Request Procedures | A request for currency conversion may be made only once per Loan Agreement, and must be submitted within 90 calendar days from and including the date of the Notice of Completion of Disbursement. * In the case that the Borrower intends to request the Conversion for the loan for which Special Account Procedure, Advance Procedure, and/or SOE procedure is adopted, the request must be submitted within 90 calendar days from the completion of the procedures for refund. |

| 4 | Timing of Request | The request shall be submitted in January 1st , 2014 or thereafter. |

| 5 | Loan Amount | The minimum and maximum principal amount of the Loan in respect of which the Borrower may request a Conversion is JPY 500 million and JPY 50 billion, respectively. |

| 6 | Track Record of Repayment | JICA shall not accept the request if:

|

| 7 | Hedging Transaction | Currency conversion can be executed only if JICA is able to enter into a cross currency swap transaction in the financial market. |

(*) For details, please see "Summary of the Product" and "Guidelines for Currency Conversion of Japanese ODA Loan".

Procedures

| Timing | Action | |

|---|---|---|

| 1 | L/A signing | Upon the borrower's request, the currency conversion option clauses are stipulated in the Loan Agreement (L/A). |

| 2 | Completion of Disbursement | The borrower submits to JICA a request for currency conversion within a defined period of time after the completion of disbursement, if it wishes to do so. JICA determines the new USD terms and conditions of the loan after the currency conversion (i.e. outstanding amount, interest rate etc.) through a cross currency swap transaction, and notifies the borrower. |

| 3 | Repayment | The borrower makes repayment of the principal and payment of interest in accordance with the new USD terms and conditions. |

scroll